Pricing Tailored To Your Stage of Growth.

Basic | Plus | Premium |

|---|---|---|

Everything in READY is included plus | Custom PricingAdd-ons in Accounting |

|

Dedicated finance expert Accrual basis bookkeeping Customized chart of accounts Monthly P&L & balance sheet Monthly cash flow statements Customized processes and integrations | Monthly equity statement Monthly cap table reconciliation Burn rate calculations Standard ratios Monthly review | Controller Services: Consolidations Financing & Due diligence reports Audit Preparation Internal controls documentation Complex Revenue recognition COGS categorization Revisions of accounting methods Revisions of accounting estimations Support for multiple projects and locations Support for multiple currencies and categories AP and AR management Inventory and EPL Tracking |

Add-ons in Financial Strategy by your CFO |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||

|

||||||||||||||

The Next Round CFO |

|---|

2000 / m Paid quarterly Save 10% on annual payments |

5 year financial Model Fundraising Strategy Monthly forecast updates Quarterly Custom Reporting & Investor reports Cash Flow Management Pitch deck reviews Custom design of KPIs Monthly KPI calculation Quarterly Team Calls Must be purchased with PROKONECT accounting |

The Unicorn CFO |

|---|

5000 / m Paid quarterly Save 10% on annual payments |

2 year budget & forecast Actual vs Forecast analysis Profitability strategies Monthly Investor or VC decks Monthly Team Calls Must be purchased with PROKONECT accounting |

Other Add-ons |

|---|

Sales taxes and R&D Claims Communication with external parties: for example, representation in a board, legal meeting, M&A or VC meeting Board Support Goal setting and accountability sessions Pitch deck assessment Fundraising strategies |

Ready |

|---|

Dedicated finance expert Accrual basis bookkeeping Customized chart of accounts Monthly P&L & balance sheet Monthly cash flow statements Customized processes and integrations |

Set |

|---|

Everything in READY is included plus |

Monthly equity statement Monthly cap table reconciliation Burn rate calculations Standard ratios Monthly review |

Go |

|---|

Custom PricingAdd-ons in Accounting |

Controller Services: Consolidations Financing & Due diligence reports Audit Preparation Internal controls documentation Complex Revenue recognition COGS categorization Revisions of accounting methods Revisions of accounting estimations Support for multiple projects and locations Support for multiple currencies and categories AP and AR management Inventory and EPL Tracking |

The Next Round CFO |

|---|

2000 / m Paid quarterly Save 10% on annual payments |

5 year financial Model Fundraising Strategy Monthly forecast updates Quarterly Custom Reporting & Investor reports Cash Flow Management Pitch deck reviews Custom design of KPIs Monthly KPI calculation Quarterly Team Calls Must be purchased with PROKONECT accounting |

The Unicorn CFO |

|---|

5000 / m Paid quarterly Save 10% on annual payments |

2 year budget & forecast Actual vs Forecast analysis Profitability strategies Monthly Investor or VC decks Monthly Team Calls Must be purchased with PROKONECT accounting |

Add-ons in Financial Strategy by your CFO |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||

|

||||||||||||||

Other Add-ons |

|---|

Sales taxes and R&D Claims Communication with external parties: for example, representation in a board, legal meeting, M&A or VC meeting Board Support Goal setting and accountability sessions Pitch deck assessment Fundraising strategies |

Don’t take our word for it, see what our clients say about us below

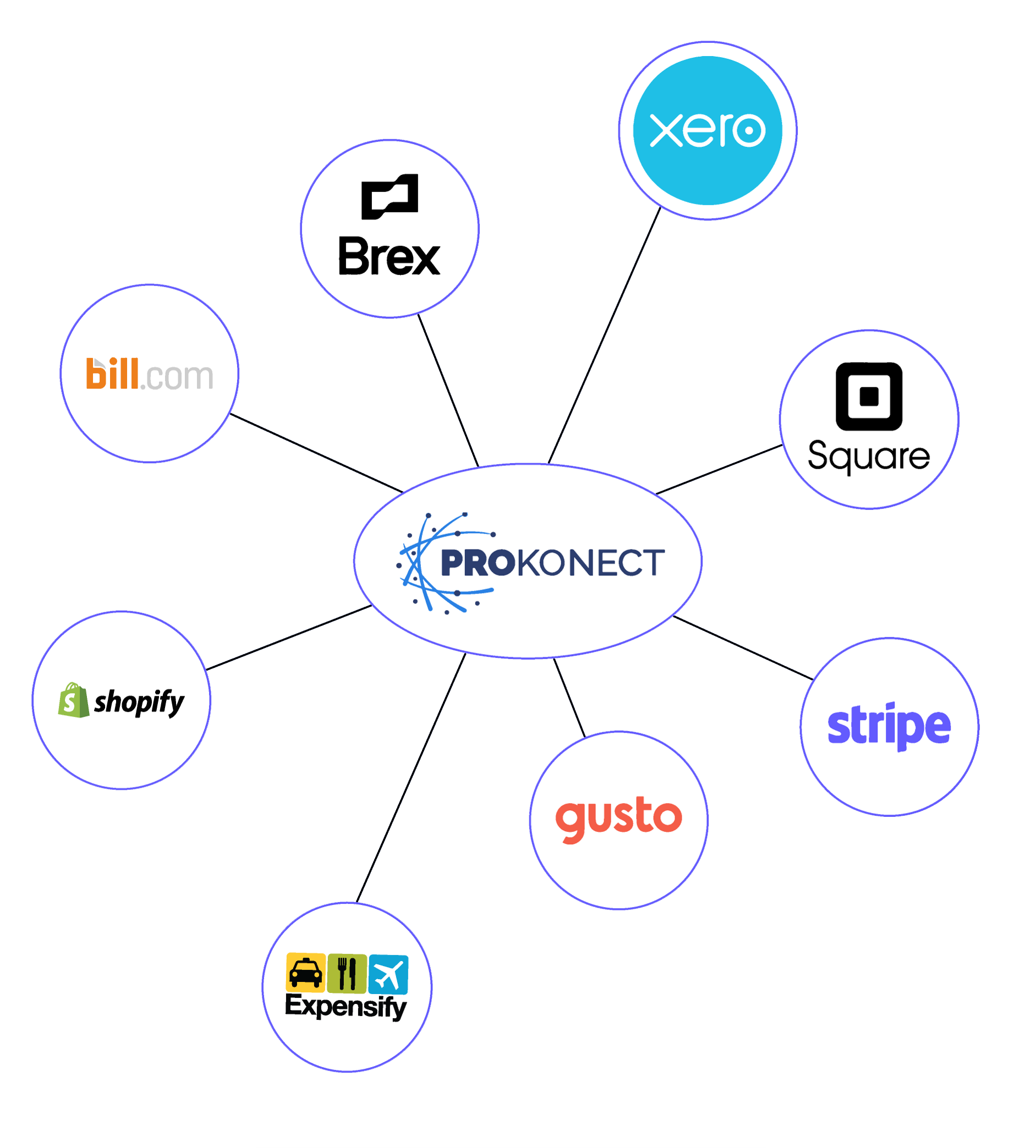

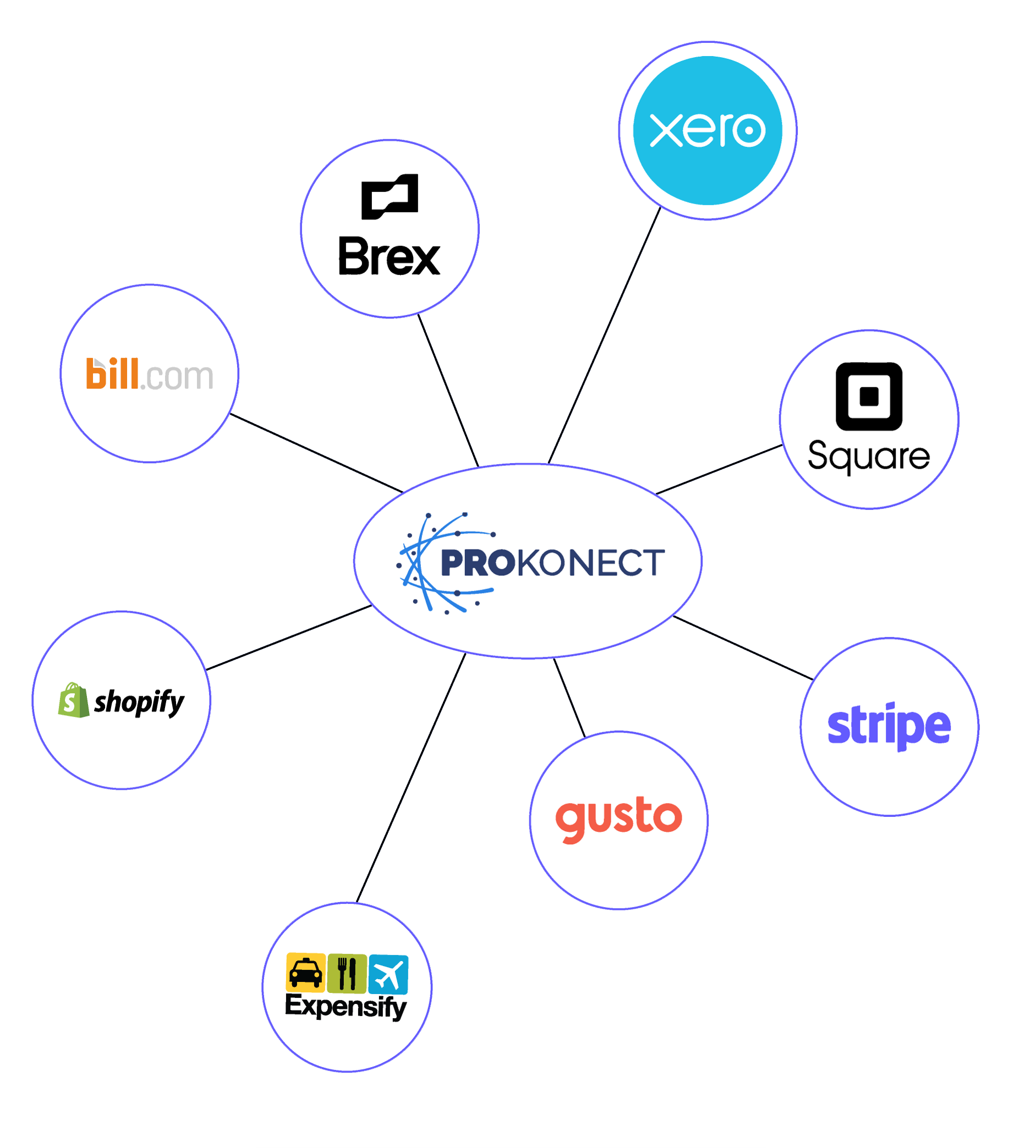

We work with the best tools in the Industry.

We integrate them to create stress-free processes.

We work with the

best tools in the

Industry.

We integrate them to create

stress-free processes.

WHY CHOOSE US

Unlimited Support

You have a dedicated expert who is fast, responsive and becomes an extension of your company. Your financial expert can assist you in board meetings and communicate with your tax accountant.

Customized Reporting

Your financial reports and processes are tailored to your insdustry and business model, like inventory management for ecommerce or specific KPIs for SaaS.

Expertise in high growth start-ups

Work with a proactive accountant and CFO who get to know your business from the ground up. Our financial insights are aligned with your vision and goals.

Global Network

If there is anything that is out of our scope of work, we refer other experts from our global network to suit your needs.

Frequently Asked Questions (FAQs)

Do you only work with funded or VC-backed start-ups?

We work primarily with funded start-ups but we do also work with early-stage start-ups and growing SMBs.

Do you have special rates for pre-revenue start-ups?

Yes! 350/month for the “Ready” pack which will be a lot of help to get started!

Where are you based?

We are 100% remote and work with start-ups from all over the US (and the world).

Do you provide tax services?

We outsource our tax services. We work with an outstanding CPA who specializes in taxes for start-ups. We communicate all of the information on your behalf to your tax accountant or R&D claim specialist so you don’t have to worry about it.

Will I be paying for my own tools and applications?

You don’t pay for any of the tools that we use to streamline your financial operations. However, we will often advise you on systems and we might recommend some tools that will be at your own expense if you chose to use them.

COMPANY

PARTNERSHIPS

LINKS

CONTACT US