This method contrasts with the gross price method, where purchases are initially recorded at their gross price and a purchase discount is only recorded if payment is made within the discount period. We learned that shipping terms tell you who is responsible for paying for shipping. Free on board (FOB) destination means the seller is responsible what are building automation systems bas for paying shipping and the buyer would not need to pay or record anything for shipping. Free on board (FOB) shipping point means the buyer is responsible for shipping and must pay and record for shipping. In the accounting department, you have matched up the receiving documents sent with this invoice and it is now ready to be paid.

What is the approximate value of your cash savings and other investments?

The discount cannot be taken during the “yellow shaded” days (of which there are twenty). What is important to note here is that skipping past the discount period will only achieve a twenty-day deferral of the payment. There are approximately 18 twenty-day periods in a year (365/20), and, at 2% per twenty-day period, this equates to over a 36% annual interest rate equivalent.

Accounting For Purchase Discounts: Net Method Vs Gross Method

FOB specifies which party (buyer or seller) pays for which shipment and loading costs and where responsibility for the goods is transferred. The last distinction is important for determining liability for goods lost or damaged in transit from the seller to the buyer. International shipments typically use “FOB” as defined by the Incoterm standards, where it always stands for “Free On Board”. Or Canada often use a different meaning, specific to North America, which is inconsistent with the Incoterm standards.

- This approach can significantly impact how companies report their finances, offering potential benefits in terms of accuracy and clarity.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- The Purchases account is usually grouped with the income statement expense accounts in the chart of accounts.

- Conversely, the perpetual inventory system involves more constant data update and is a far superior business management tool.

- By recording the net amount, companies can more accurately reflect their actual financial obligations and revenues, leading to a clearer financial picture.

Construction Accounting 101: Expert Guide for Contractors

The net method in financial accounting offers a streamlined approach to recording transactions, particularly when dealing with discounts and payment terms. It provides a more accurate representation of cash flow and financial health by recognizing potential savings upfront, leading to improved decision-making for businesses focusing on cost management and efficiency. Another important consideration when using the net method is the treatment of uncollectible accounts. Since the net method records transactions at their net amounts, any subsequent realization that a receivable is uncollectible requires adjustments to the financial statements.

When employing the net method, calculating discounts becomes an integral part of the initial transaction recording. This approach requires businesses to anticipate the discount at the time of purchase or sale, rather than waiting until the payment is made. For example, if a company purchases goods worth $10,000 with a 2% discount for early payment, the transaction is recorded at $9,800. This proactive recording ensures that the financial statements reflect the most accurate and realistic figures. Perpetual inventory system is a technique of maintaining inventory records that provides a running balance of cost of goods available for sale and cost of goods sold for a period. Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Accounts payable are recorded at their expected cash payment at the time of purchase. If the payment is made within the discount period, Accounts Payable should be debited, and Cash should be credited for the amount at which the payable was originally recorded. For example, if there was a 2% discount on the above purchase, it would amount to $200 ($10,000 X 2%), NOT $208 ($10,400 X 2%).

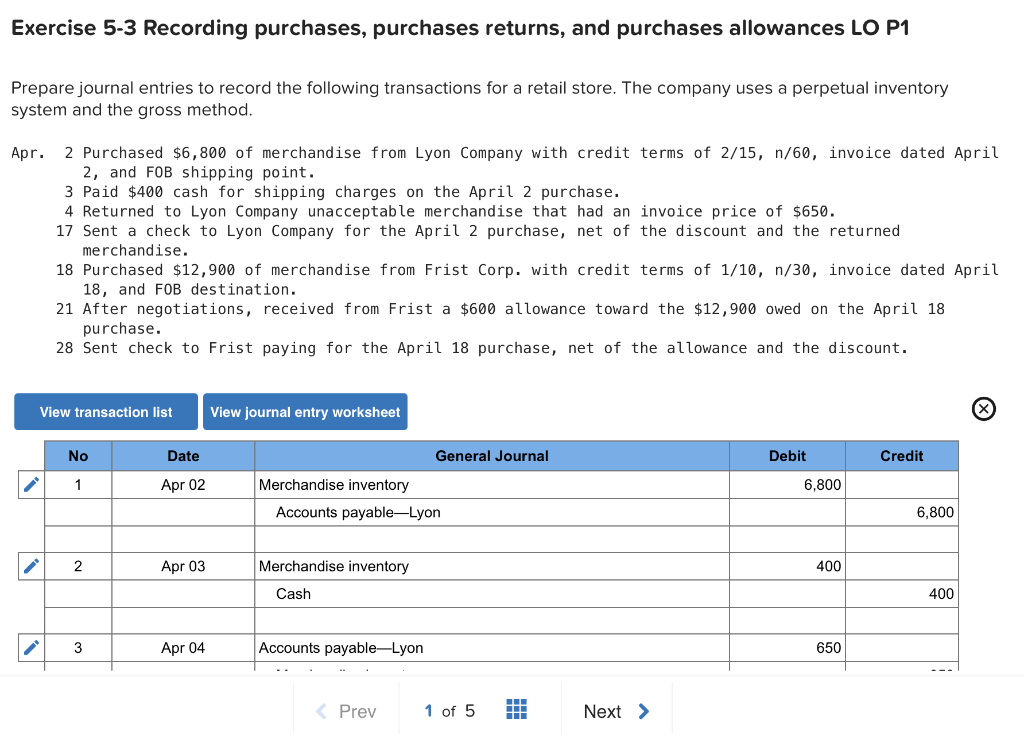

In this section, we illustrate the journal entry for the purchase discounts for both net methods vs gross method under the periodic inventory system. Accounting for purchase discounts, we can be recorded under either the net method or the gross method. Both methods provide the same result; however, the accounting journal entry is slightly different. In both cases, the accounts receivable subsidiary ledger is updated, but not inventory, because we don’t do that under the periodic method. The Bryan accounts receivable subsidiary ledger now shows that Geyer owes $16,700, and a call or letter to Geyer would verify that their accounts payable matches if they are using the gross method.

Understanding its concepts, calculations, and applications is essential for businesses aiming to optimize their financial reporting practices. If the invoice is paid within the first ten days, Big Guitar, LLC would be able to record the payoff at the discounted price. Furthermore, the use of the account, Purchase Discounts Lost; highlights the total cost of not paying within the discount period. Importantly, storage costs, insurance, interest and other similar costs are considered to be period costs that are not attached to the product. Instead, those ongoing costs are simply expensed in the period incurred as operating expenses of the business. Take a moment and look at the invoice presented earlier in this chapter for Barber Shop Supply.

The net price method, also known as the net method, is an accounting technique used to record purchases and discounts. Under this method, purchases are recorded at their net price, which is equal to the gross price (the original price) minus any purchase discounts available. Before we dive into the COGS details for the periodic system, begin to familiarize yourself with this chart. This is a quick way to compare the differences between how the two methods record the details involved with inventory. Notice that we did not post the purchases to the inventory account, which is a major difference between this periodic system and the perpetual system.

This is usually expressed as a percentage and is typically provided for in the terms of sale. Some may post the charge as an offset to the expense, as an offset to a payable, or as an income item. The F.O.B. point is normally understood to represent the place where ownership of goods transfers. From 1 January 2024 the following principles relating to the carryover of annual leave apply.

By recording this adjustment, the accounts payable need to be adjusted back to the full invoice amount. Acas provide free and impartial advice to employers and workers on employment matters. The net method works by recording any purchase discounts obtained from suppliers as an immediate offset to the cost of goods purchased. Net method of recording purchase discounts is a method of recording purchase discounts in which the purchase and accounts payable are recorded at the net of the allowable discount. The gross method may inflate sales and purchase figures initially, potentially skewing metrics such as profit margins and return on sales. This can provide a different perspective on operational efficiency and profitability compared to the net method, where discounts are embedded in the initial transaction entries.